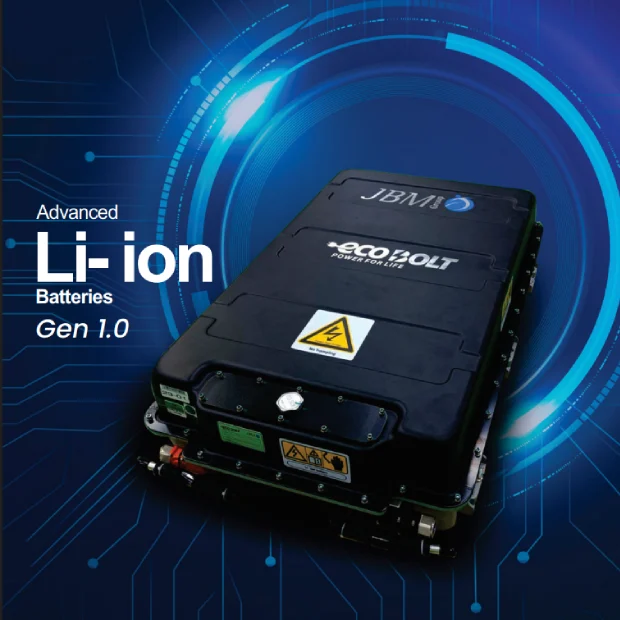

Diverse chemistries for optimal performance, energy density, and longevity.

Rapid charging reduces downtime, ensuring quick readiness for operation.

Advanced safety features protect against thermal issues and overcharging risks.

Proactive monitoring extends battery life and optimizes performance efficiently.

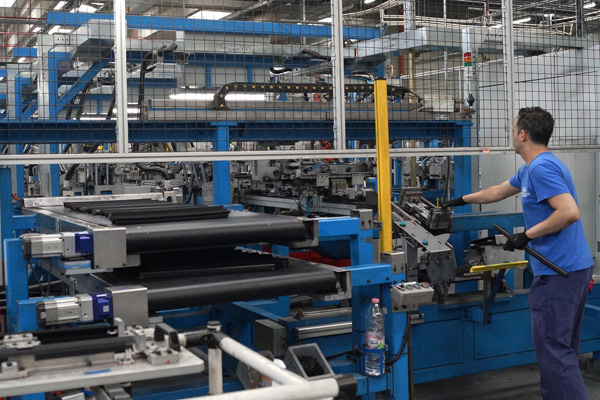

JBMG, is a market leader in ultra-fast charging and multifacet battery systems, which provides design, development, manufacturing, sales and after-sales services for all application needs. With different product offerings depending on customer mission profile and requirement for EVs (Electrical Vehicles), our battery packs are intelligent and modular, with unique chemistry for high energy density, light weight and high DOD. Our products are AIS-038 Rev-02 & UN38.3 certified.

JBMG, is a market leader in ultra-fast charging and multifacet battery systems, which provides design, development, manufacturing, sales and after-sales services for all application needs. With different product offerings depending on customer mission profile and requirement for EVs (Electrical Vehicles), our battery packs are intelligent and modular, with unique chemistry for high energy density, light weight and high DOD. Our products are AIS-038 Rev-02 & UN38.3 certified.

JBMG is a market leader in ultra-fast charging and multifaceted battery systems which provides design, development, manufacturing, sales and after-sales services for all application needs. With different product offerings depending on customer mission profile and requirement for EVs (Electrical Vehicles), our battery packs are intelligent and modular, with unique chemistry for high energy density, light weight and high DOD. Our products are AIS-038 Rev-02 & UN38.3 certified.

JBMG is a market leader in ultra-fast charging and multifaceted battery systems which provides design, development, manufacturing, sales and after-sales services for all application needs. With different product offerings depending on customer mission profile and requirement for EVs (Electrical Vehicles), our battery packs are intelligent and modular, with unique chemistry for high energy density, light weight and high DOD. Our products are AIS-038 Rev-02 & UN38.3 certified.

JBMG is a market leader in ultra-fast charging and multifaceted battery systems which provides design, development, manufacturing, sales and after-sales services for all application needs. With different product offerings depending on customer mission profile and requirement for EVs (Electrical Vehicles), our battery packs are intelligent and modular, with unique chemistry for high energy density, light weight and high DOD. Our products are AIS-038 Rev-02 & UN38.3 certified..

Integrated, small, light, energy – saving and eco-friendly

Intelligent centralized monitoring, maintenance and management

Convenient operation, standardized cabinet installation

For marine, RV, backup power, solar and other where lead-acid is used.